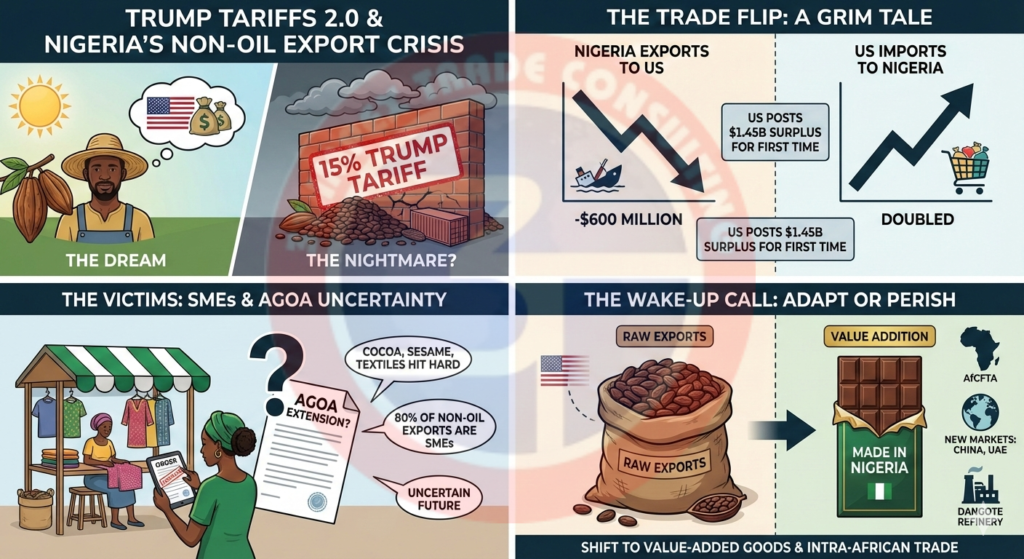

Imagine you’re a cocoa farmer in Osun State, Nigeria, who’s finally broken into the lucrative US market after years of hustling. Your beans are premium, your exports are soaring, and you’re dreaming of expanding your farm, maybe even sending your kids to better schools. Then, bam—overnight, a 15% tariff wall crashes down, courtesy of President Donald Trump’s “reciprocal” trade policies. Prices plummet, buyers hesitate, and suddenly, that American dream feels like a rude awakening. Is this the end of Nigeria’s bold push for non-oil exports, or just a bumpy detour? Let’s dive in.

Nigeria has long been shackled to oil dependency, with crude accounting for over 90% of its export earnings for decades. But in recent years, there’s been a quiet revolution brewing. Non-oil exports hit a historic high of $6.1 billion in 2025, surging 24% year-on-year in the first quarter alone. Think cocoa beans from the lush fields of Ondo, sesame seeds from the savannas of Kano, cashew nuts cracking open opportunities in Benue, and leather goods crafted by artisans in Aba. This isn’t just numbers on a spreadsheet—it’s real people, from smallholder farmers to ambitious SMEs, betting on diversification to break free from the boom-and-bust cycles of black gold. The African Continental Free Trade Area (AfCFTA) has fueled this fire, promising a $3 trillion market right on our doorstep, but the US has remained a prized gateway, thanks to the African Growth and Opportunity Act (AGOA).

Enter Trump Tariffs 2.0. Fresh off his 2024 re-election, President Trump didn’t waste time resurrecting his “America First” playbook. In late July 2025, he signed an executive order slapping “reciprocal” tariffs on countries he deemed unfair traders, including Nigeria. Our tariff rate jumped from 14% to 15% on a wide range of goods, effective August 7. Crude oil got a pass—phew for the big players in the Niger Delta—but non-oil exports? They took the hit square in the gut. This wasn’t some abstract policy memo; it was a shockwave that rippled through supply chains overnight.

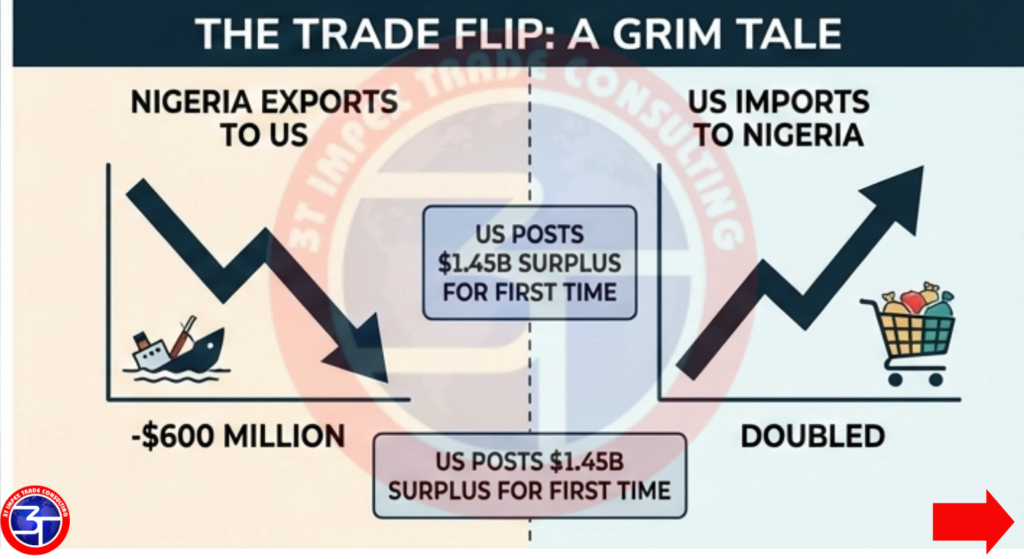

The numbers tell a grim tale. In the first nine months of 2025, Nigeria’s exports to the US plummeted by nearly N1 trillion (about $600 million at current rates), while US imports into Nigeria more than doubled. The US flipped the script, posting a $1.45 billion trade surplus with us for the first time in years, as American exports surged 60% to $5.94 billion. Picture this: While Nigerian exporters scrambled, US firms flooded our markets with everything from machinery to consumer goods. It’s like inviting someone to dinner and ending up paying the bill twice.

But why Nigeria? Trump’s tariffs target nations with trade imbalances or those not playing by his rules. We’ve got a deficit with the US, but it’s largely due to our raw material exports versus their finished products. Analyst points out structural issues: We’ve underutilized AGOA’s potential, with oil dominating despite the act’s focus on non-oil diversification. Non-oil shipments like cocoa, sesame, and cashews have grown, but they’re niche. Now, with tariffs biting, demand from American importers has cooled. A study by the International Trade Centre estimated that without AGOA preferences, apparel and textile exports could drop 9.7% by 2029, costing $138 million in lost revenue across beneficiaries. For Nigeria, that’s jobs evaporating in factories from Lagos to Kano.

Take the apparel sector, for instance. Nigerian textiles, vibrant with local prints and affordable labor, had been eyeing AGOA’s duty-free access to compete with Asian giants. But tariffs add costs that make our products less competitive. “It’s like running a marathon with weights on your ankles,” says a Lagos-based exporter I spoke with (anonymously, fearing backlash). Her shipments of ready-to-wear garments to US retailers dropped 30% post-tariff. She’s not alone—SMEs, which make up 80% of our non-oil export base, are the hardest hit. These aren’t faceless corporations; they’re entrepreneurs like Aisha in Abuja, who turned her tailoring hobby into a business exporting bags and shoes. Now, she’s pivoting to local markets, but the margins are slimmer.

And then there’s the AGOA twist. The act lapsed on September 30, 2025, sending jitters through African exporters. Trump extended it for one year to December 31, 2026, retroactively, but with strings attached. His administration wants a rework to favor US firms more—think reciprocal market access for American businesses, farmers, and ranchers. Analysts call it a “fragile reprieve.” Oxford Economics’ Brendon Verster notes that Trump’s tariffs “effectively negate AGOA” in many cases, as not all goods are covered duty-free anymore. For Nigeria, this means uncertainty: Will we stay eligible? A US report is due, and last year’s 15% hike looms large.

Yet, amid the gloom, there’s a silver lining—or at least a call to action. Nigeria’s turning inward and outward. The Dangote Refinery, Africa’s largest, is a game-changer. It’s exporting refined fuel to the US while importing American crude, creating a symbiotic loop. Sunoco and Shell are buying Dangote gasoline, proving we can play in the big leagues even with tariffs. Broader non-oil exports are booming regionally: AfCFTA has opened doors to a $10 billion trade potential with Morocco alone, focusing on agro-businesses. We’re strengthening ties with the UAE and China, where tariffs aren’t an issue.

Experts urge a shift: From raw exports to value-added products. Why ship raw cocoa when we could export chocolate bars? Import substitution is key—boost local manufacturing to cut forex scarcity and import bills. And with global trade growth crawling at 0.5%, pivoting to intra-African markets isn’t optional—it’s survival.

Is Nigeria’s non-oil dream turning into a nightmare? Not overnight, but the tariffs are a wake-up call. They expose vulnerabilities but also highlight resilience. For farmers in Osun or entrepreneurs in Aba, it’s about adapting: Diversify markets, add value, and lobby for better deals. Trump’s policies might sting now, but they could force the innovation Nigeria needs to thrive beyond oil. After all, in trade wars, the agile win. What’s your move, Nigeria?